RESEARCH - getting real insights on your (and my) audience

We all need to check the focus of our activity, myself included, and knowing more about who you are selling/speaking to and the market is better than not knowing.

Hello again!

As promised I am back after my month off, for the 2nd year in a row I used August. I honestly ran out of steam in many respects, and I had my birthday, it was quieter, and you know, other things came up, like the sun occasionally. Life and work eh?

I also wanted to take a break and think about what I was going to share. I never want to share for sharing’s sake, as I know I cannot commit to it and you invariably won’t read. I believe in less-is-more sometimes, unlike some more frequent ones, I would rather deliver something meatier/longer less frequently, than a content-calendared ‘must think of something to post this week’ type situation, the love language of the 2024 platform algorithms it seems.

With my break, I looked back on the 2.5 years plus of writings, and tried to think about not only what I haven’t yet written about, but considering my own mantra of getting back to basics, ensuring I stay true to my own credo of this in the first place.

We as an industry of marketers and brands get into all kinds of battles and I myself have had to try to delineate some of it. Marketing isn’t advertising. Tactics aren’t a strategy etc. Promotion is only part of the mix. You get the idea.

But the subject of this is the very thing I have done in pursuit of this writeup; to that end, we are going to talk about Research. It is an important thing needed, whoever or wherever you are. Research is never a bad thing.

Research, like targeting, can be is a bell curve, doing a bit is better then none. Or it could be a diminishing return plateau, the deeper you go the smaller the increments of odds going in your favour perhaps, e.g. you can go too far and lead yourselves into cul-de-sacs with not many target customers to reach. But for the purpose of this, let’s all assume we could do a bit more. Which is better than a bit less.

Research is the genesis of all good marketing strategy…

I am not going to get the breadth of this subject into one newsletter. It (can be) far too comprehensive; perhaps I build on more parts in greater detail in the future.

To sell to your audience, you need to understand their mindsets and challenges,

To understand them is to commit to learn about them..

To learn about them, you will need to research them.

To be more researched/informed, means you are more likely to be their solution - and not disingenuously.

To be their solution, means they buy from you and more frequently. A marketing win!

The whole point of marketing is to increase the odds of selling more of your product or service. Through different means and a process that includes research. Why would you not tee the golf ball with the initial iron correctly to get to the green quicker? Or sharpen the axe more to chop the tree more efficiently? These starting steps ensure you are more informed about your audience, your market, and even your business. From there, you get clearer customer orientation, and you can position yourself with a genuinely informed strategy that gets to the bone quicker.

Key starting points for Research

In terms of tools and techniques, these can be budget and sector dependant (and even region- but there are fundamental pieces of the jigsaw that create a rounded picture of what is what, to give you an idea of what is going on. Perhaps insights (which means something new, not everything is an insight of course).

The 3Cs are a great starting point

Customer - This arguably the most important of the Cs. If you are truly a customer oriented business you will deliver products and services in your Company, and who cares about Competitors right? The more we know as above, the better. Some thought starters :

Qs : Who are they? What do they want? What are they buying? Why are they buying? How do your products make them feel? What are their pain points? What is your product solving? What else do they need? Who else is serving their need? etc

Company - Knowing what is going on at mission control is probably a good start. Understanding your numbers, your products, any anecdotes, feedback etc is critical to ensuring you are informed :

Qs : What do we know? What don’t we know? Where are we making money? Where aren’t we? What is the business goal? What are we selling? Who are your audience? Who aren’t your audience? What are the future plans? etc

Competition - People argue this. Smug utopians may say if you are doing it properly it shouldn’t matter. But the paranoid marketeers knee jerk to every move the others do. The answer is in the middle. You deny their existence in your buyers mind is at best arrogant and at worst deluded/dangerous. You obsess, then you can set unintended behaviours that defy customer need. The goal is to understand what is going on, and how they are received, and having a position/plan accordingly you can believe in.

Qs : Who are they? What are they doing? What are they saying? What are we selling? Who are the biggest/dominant players? What aren’t they doing? How do they communicate? How do customers feel about them? Channels/Formats? etc.

But How?

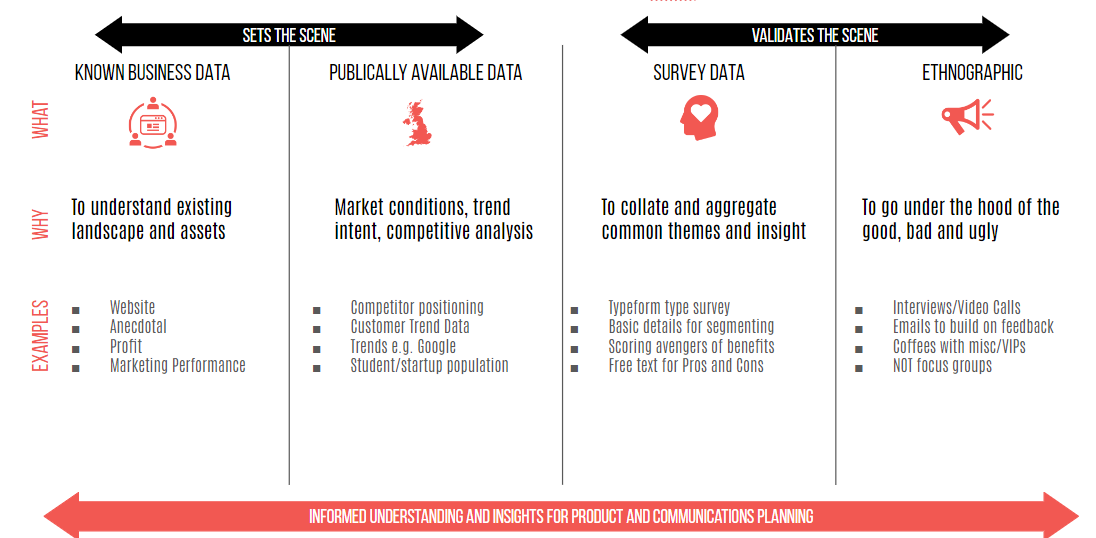

There are other ways to slice and dice too. When I kick off with a client, I give them a flavour of the kind of research I will do and why. here I broke it into 4 areas.

I give them a coherent page to think about. Business and Market Data solidifies a lot about the Company and Competition, and Survey/Interviews/Ethnography help understand the customer. There are various ways you can do this by sector of course.

But the methods on this one (with Education client) but not limited to included ;

Client Website

Client Management

Client Strategy

Financial Data (e.g. No users x Revenue per user)

Google Analytics/Dashboards

Government reports

Sector Reports

Trends/Attitudinal Data

Google Trends

Social insights/listening

YouGov

Client (and ex client) surveys

Interviews/Email follow-ups

On site meetings/anecdotal

Above all, you need to create budget, time and space. Some of the above is free but time costing, some is quicker but more costly. Some say 5-10% of your budget should go to research, and that is a decent guideline. But most importantly is a culture of research to find out what is happening, collect data, anecdotes and sentiments, to ultimately unlock the knowledge and insight you need. It should be a first port of call before any new campaign/rebrand.

So what? Getting to a position and in turn a strategy

I like this Venn diagram on positioning below from another consultancy.

It is never going to be that perfect, but it gives you a guidance philosophy. I use a pizza analogy with my clients, but research is needed to inform the key areas of differentiation, understanding yourselves, understanding other suppliers and businesses, and understanding your customer needs. However you shape/call it, it informs a lot. Remember, differentiation is hard and naive to think you are totally unique, but the more you understand, the better you can target and communicate.

USE CASE - Over to you the reader, how are you getting on here?

I wanted to practice what I preach. Although less bothered about ‘Competition’ as this isn’t a business (although knowing that others post weekly ensured I wanted difference) and I am not writing on behalf of a ‘Company’ exactly albeit referencing Archmon form time to time), I see you readers as ‘Customers’ for the purpose of this.

I have hundreds (definitely not thousands) of subscribers, but you are all perfectly formed, and an exceptionally diverse, learned bunch. This is not me playing some sycophantic lip service, looking at who followed me is genuinely flattering. So you are a large enough cohort for me to want to care about the breakdown but small enough for me to feel I can speak to you as well as possible.

So I took it upon myself to get to know you better. A bit of quick and dirty research. I had a look at you, and where I could decipher who is who and where you are/what you do. Where I was able to ascertain, I had a peek (just explaining any random LinkedIn stalks here) and I ran some numbers :

I wanted to see what each type of person is, where they work and in what sector if a brand/non-marketing business. The natural entry point of these subscribers was always going to be my network, so mainly ex agency and media colleagues, clients and brands, partners, students who I have given lectures or talks to and general network through LinkedIn & Substack (which I’m always amazed and honoured to get recommended by some great fellow writers). The latter have opened up learners and client brands more, thanks to unintended consequences of sharing and referrals. Time for a new line in the sand. I also had a lot from Twitter at the start, but we all know what happened there. So what did I gauge from a simple list of email addresses?

Where are you? You work in Agencies, Brands, Marketing vendors or self employed, or are studying.

So What? A little variance, but marketers in agencies and brands dominate. The minorities are marketing practitioners or studiers. So yes, marketing is fine.

What/Who are you? You are marketers, strategists, specialists in areas like digital, ecommerce or copywriting, and students.

So What? You all have an interest in different areas. And as marketing is interdisciplinary, topics written about apply to most disciplines, strategic or tactical. Therefore, a broad range of marketing topics is fine.

If a brand/non marketing, what sector are you? Well clearly there is no dominance. amazing to see a range of professionals junior and senior, from large and small brands, selling everything from anti virus software to personal hygiene products.

So What? Obviously I cannot go down any kind of sector specialism route, and maintains initial hypothesis of sharing more generic marketing fundamentals.

Overall So What?

These cursory findings help validate the themes of content I share, and should command a certain amount of generic application regardless of position in career/ role, and there re fundamentals that we can only do better. But what it has also done is given me tramlines for certain case studies and examples I could use to resonate with audience in the future. I also looked at the best performing/most read/shared, so I know which types of newsletter get read more, which is kind of the point.

And that, is why, bottom line - I have written about Research. There is not a single one of you who won’t benefit from doing a little more research. Whether you are selling face cream, studying for your PhD or dispensing tech solutions. this is a fundamental. How you do it will vary. That said, the research is always ongoing, including interviews, ethnographic feedback etc.

Ethnographically, If there is anything you would like to share with me, on things you would like to read, more or less of, tell me. I want to make it as useful as possible for you, whilst of course remaining sympathetic to the wider audience and the objective which, thankfully, is informed enough to remain intact.

Thanks for reading his far, I value your insights. Literally.

SA

P.S. I really hope you are getting a semblance of value out of this. If so, and you think any other marketer or business owner would, feel free to share/forward this to them. Also, follow me on LinkedIn, The place formerly known as Twitter, or even my company page. If you want to discuss anything, you need some marketing advice, or you just want to discuss something I’ve said, drop me a line. Thanks and happy reading/marketing!